We aim to build enduring relationships with all our clients by providing quality services that meets their changing needs over life. It’s important to remember that continually reviewing your strategy is essential.

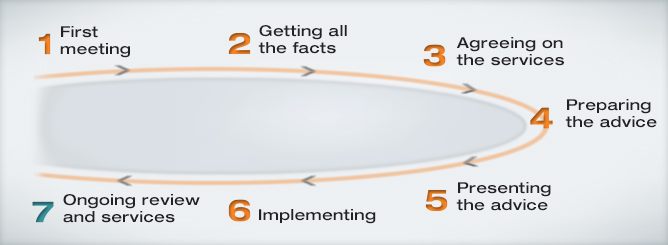

How we will provide advice to you

1 First meeting

- Getting to know you

- Ensuring you understand the information we give you

- Learning about your goals and objectives

- Establishing which advice services you’ll require

2 Getting all the facts

- Completing a profile of your personal and financial goals

- Establishing the right level of risk for you

- Developing a clear picture of your situation

3 Agreeing on the service

- Issuing a letter of engagement

- Discussing our services and making the costs involved clear

- Agreement for us to prepare specific advice

4 Preparing the advice

- Analysing possible strategies and options

- Researching potential products and relevant legislation

- Preparing our recommendations

5 Presenting the advice

- Presenting our advice in a Statement of Advice (SoA)

- Discussing the SoA and any Product Disclosure Statements

- Answering your questions and ensuring you understand and are comfortable with our recommendations

6 Implementing

- Getting your permission to proceed

- Implementing the agreed strategy

- Documenting administration

- Placing your investments and taking out policies

- Confirming your plan is in place

7 Ongoing review and service

- Examining portfolio performance and recommending changes

- Considering any new legislative opportunities or threats

- Accessing our in-house investment research to guide ongoing investment decisions

- Reviewing your financial situation, needs and objectives